Key Aspects to Consider When Selecting the Right Bookkeeping Practice

Selecting the ideal audit practice is a critical choice that can dramatically influence your monetary health and overall organization success. Secret elements such as the professionals' credentials, their locations of expertise, and the series of solutions provided must be carefully assessed. Additionally, reliable communication and openness in charge structures are crucial for promoting a productive collaboration. As you consider these components, it's important to additionally review the importance of customer reviews and the company's credibility. What other facets should one ponder to make sure an optimal option?

Know-how and Certifications

In the world of accountancy, proficiency and qualifications offer as the cornerstone for efficient financial administration. When picking an accounting practice, it is crucial to consider the credentials of the specialists involved.

In addition, field of expertise within the accountancy field can substantially impact the top quality of services provided. Some professionals focus on locations such as tax preparation, auditing, or forensic accountancy, which can give an extra detailed understanding of particular customer demands. In addition, industry experience is important; accounting professionals with a tried and tested record in your specific field will certainly be extra experienced at navigating the unique monetary obstacles you might face.

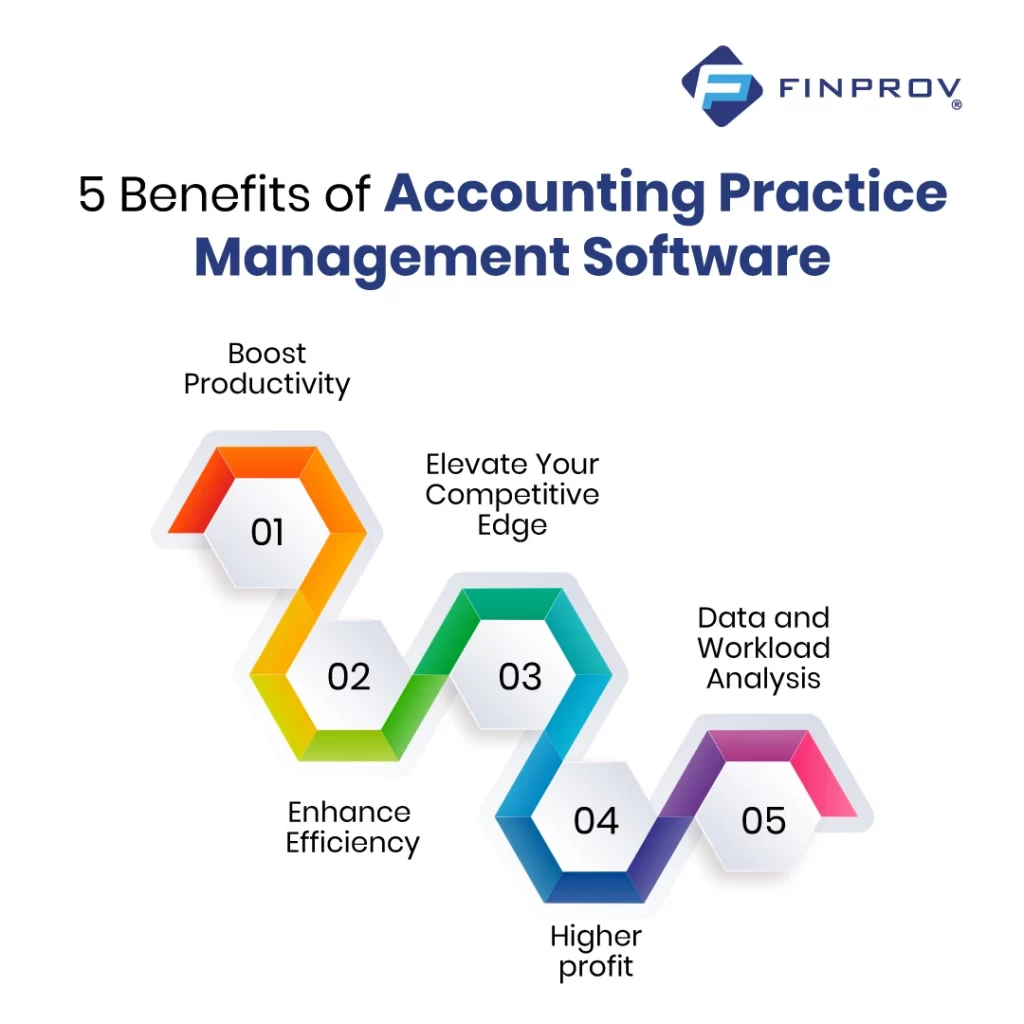

Lastly, technology efficiency plays an important function in contemporary audit methods. With the raising dependence on bookkeeping software application and monetary analytics, guaranteeing that the method uses professionals who are adept with these devices can improve precision and performance in financial reporting. Succentrix can help you start an accounting practice. Choosing a firm with the appropriate proficiency and credentials will ultimately cause appear monetary decision-making

Variety of Solutions

Businesses, in particular, must take into consideration companies that supply customized services pertinent to their industry. A practice experienced in handling the complexities of manufacturing or non-profit fields can give insights and remedies that common companies might ignore. Added services such as pay-roll monitoring, service valuation, and sequence planning can be invaluable as business grow and advance.

In addition, make sure that the accountancy technique stays upgraded with the most recent policies and technological improvements, as this can dramatically enhance the quality of solution supplied. Ultimately, a company that uses a wide variety of solutions is better placed to act as a long-term companion, with the ability of adapting its offerings to match your changing economic landscape. This versatility can add dramatically to your company's overall success and financial wellness.

Communication and Accessibility

Effective communication and access are crucial factors when picking a bookkeeping method, as they directly affect the high quality of the client-firm connection. A company that focuses on clear and open interaction cultivates trust fund and guarantees that clients really feel valued and recognized. It is essential to evaluate exactly how a practice interacts essential information, whether through routine updates, punctual actions to inquiries, or the ability to explain complex financial principles in nonprofessional's terms.

Ease of access is equally essential; clients look at this web-site need to really feel confident that they can reach their accounting professionals when required. This consists of considering the company's operating hours, availability for appointments, and responsiveness via numerous channels, such as phone, e-mail, or in-person conferences.

Furthermore, innovation plays an important role in enhancing communication and access. A practice that leverages contemporary communication tools, such as safe customer sites or mobile applications, can assist in information sharing and make it less complicated for customers to access their monetary data anytime, anywhere. Ultimately, a my sources company that stands out in communication and availability will not only simplify the bookkeeping procedure but additionally construct a strong, long-lasting collaboration with its customers, guaranteeing their needs are fulfilled effectively.

Charge Structure and Openness

Comprehending the fee structure and making sure transparency are fundamental facets when evaluating a bookkeeping technique. A clear and comprehensive charge framework permits clients to prepare for expenses and budget accordingly, decreasing the capacity for misunderstandings or unanticipated expenditures. It is important to inquire whether the practice utilizes a set cost, per hour price, or a mix of both, as this can significantly influence overall expenses.

Additionally, transparency in billing practices is necessary (Succentrix can help you start an accounting practice). Clients must get clear billings laying out services made, time invested, and any kind of service charges. This level of detail not only promotes depend on but likewise makes it possible for customers to assess the worth of the solutions offered

Finally, take into consideration whether the accountancy technique is willing to offer written contracts that lay out all services and associated costs. This can work as a secure against shocks and ensures both events have a good understanding of expectations. By focusing on cost framework and openness, customers can make enlightened decisions that align with their economic goals.

Customer Evaluations and Reputation

Lots of clients discover that the reputation of a bookkeeping practice plays a vital role in their decision-making procedure. A well-regarded company is usually associated with reliability, professionalism and reliability, and knowledge. Clients generally choose testimonials and reviews to evaluate the experiences of others, which can dramatically affect their selection of audit solution.

Additionally, it is a good idea to investigate the practice's performance history with respect to compliance and honest requirements. A company that has encountered corrective activities may present a danger to your economic honesty.

Final Thought

In final thought, picking a proper accounting method necessitates cautious examination of several essential factors. Complete research study into client testimonials and the company's general track record offers important insights right into integrity and professionalism and reliability, making sure educated decision-making.